Plan For A

Better Tomorrow

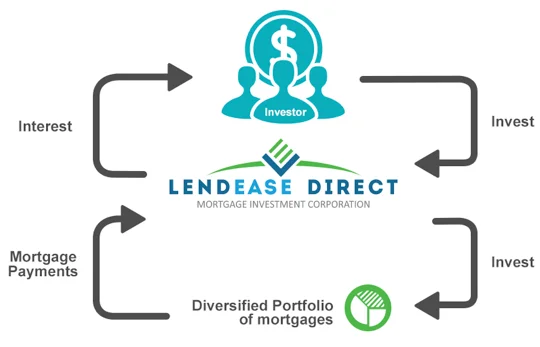

Mortgages as an Investment

Investing in mortgages gives you the opportunity to redeem high

rates of return with minimal risk. LED provides you with the option to

invest, while we and our team of experienced individuals manage the funds

and you reap the benefits. This is by securitizing real estate and lending

to qualified borrowers using our risk analysis model. With the vastly

changing real estate market, LED MIC evolves and adjusts our prerequisites

appropriately, ensuring that your investments are managed wisely and yields

high return.

Our Process Is Simple

Portfolio Selection & Administration: Funds

that are transferred to LendEase Direct MIC are overlooked by their management team

who selects the mortgages that the corporation will invest in. Day to day tasks to

administer portfolios that were attained by LendEase Direct include: receipt and

posting mortgage payments, funding new mortgages, renewing existing mortgage loans,

and maintaining bank records and mortgage amortization schedules.

In Ontario, the mortgage administering industry is regulated by the

Financial Services Commission of Ontario (FSCO). All mortgage brokerages,

administrators, brokers, and agents need to be licensed with FSCO to conduct

mortgage brokering business in Ontario.

LED is administered by Easy Lend Administrator Inc., a licensed mortgage

administrator with FSCO. More information on FSCO and the mortgage brokering

industry can be found on FSCO’s web site.

Disclaimer: Investment returns will fluctuate and are not guaranteed. LendEase advises you to read all informational material prior to investing.

What We Offer

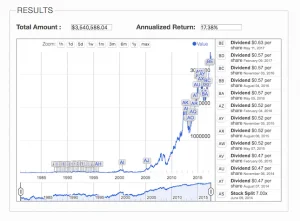

Superior Returns on Investments

We offer up to 8% per year, compared to 1% on GICs which is typically offered by banks.

Safe and Secure

Your investments are securitized by real estate through a selective process administered by our team of professionals. We primarily lend on residential and commercial properties located throughout the Metropolitan areas of Canada. These regions have proven to be the most recession resistant areas. LendEase has a selective list of appraisers that are trusted in the industry to give us realistic and reliable values in the volatile market today.

Diversification

Compared to a Syndicate mortgage where you’re investing towards a single real estate loan, LendEase investors own a diversified portfolio of mortgage loans. The portfolio is professionally managed and invested strategically to offer you high returns and security.

Regular Income

Investing in mortgages is a form of regular income. Investors can be paid in the form of dividends on a monthly basis or have the option to enroll in our Dividend Reinvestment Plan (DRIP) offering you higher return. Learn more below.

Employee guarantee

The LendEase CEO, directors and employees have also invested and are shareholders in the company. The CEO has also personally guaranteed up to $3 million of the individual shares. The management and staff are personally vested in ensuring that the company portfolio will yield high investment returns in parallel to securing our investors’ capital strategically.

Secured Funds

Olympia Trust; a reputable third party acts as an unbiased administrator and assists in holding investors’ funds in trust, processing investment transactions as instructed, and issuing tax documentation.

Redeeming Your Shares

Shareholders have the ability to redeem their shares at any time, providing they have given 90 days’ notice. A 4% retraction payment would apply when redeeming shares within 12 months of issuance; 2.5% retraction payment for shares redeemed between 12 to 24 months.

Investor Referral Program

Now that you’ve seen the growth in your investment, take the advantage of the opportunity

to

guide your friends and associates and be rewarded for it.

Disclaimer: Investment returns will fluctuate and are not guaranteed. LendEase advises you to read all informational material prior to investing.